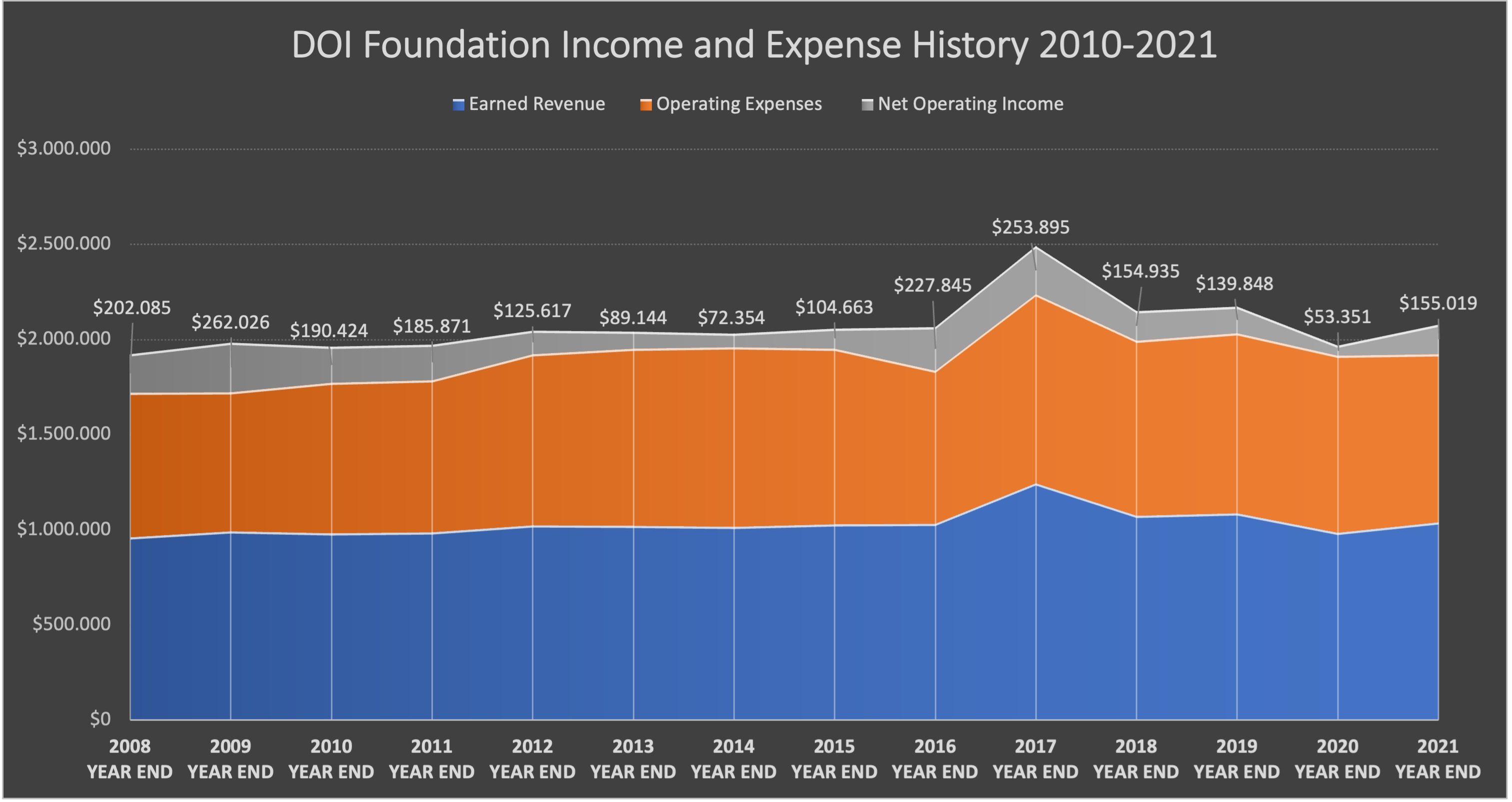

The DOI Foundation operates on an annual budget of around $1 million USD. All revenues come from annual fees paid by the Registration Agencies and our Members. These fees are set and reviewed annually by the Board.

About 70% of our expenses are used for the running and maintenance of the DOI System infrastructure.

We maintain a reserve fund to support long-term sustainability. This is managed by the Executive Committee and overseen by the Audit Committee

Each year we strive to generate a small net operating income and have been able to do so nearly every year. Below is an overview of how this has changed over time.

The DOI Foundation is a not-for-profit organization and is therefore prohibited from activities not permitted to be carried on by a corporation exempt from US federal income tax under Section 501(c)(6) of the Internal Revenue Code of 1986 et seq.

Form 990s

As a not-for-profit, we are tax-exempt. To maintain that status, we undergo a financial audit each year by an independent accounting firm. We also prepare Form 990 each year, which the US IRS requires and is made publicly available. It gives an overview of what we do, how we are governed, and detailed financial information.

Below are our recent Form 990s